Trying to figure out NFTs (Part 1)

...and down the rabbit hole we go (Reading time: Approx. 8 and a half minutes)

`Curiouser and curiouser!' cried Alice (she was so much surprised, that for the moment she quite forgot how to speak good English); `now I'm opening out like the largest telescope that ever was! Good-bye, feet!'

-Alice's Adventures in Wonderland, Lewis Caroll

1and also

Being late to the party beats not showing up at all

-Some smart ass

I will assume that the dear reader holds a basic understanding of the NFT concept by now. It’s not like the NFT c̶a̶b̶a̶l̶ crowd is not trying hard enough to evangelize their message, but regardless, the crowds out there, even the less tech-savvy ones, are becoming more intrigued by the whole concept. And that must mean something right? So in this series of posts, we will try to find out what is the value of NFTs, if and how they are different from other use cases of the blockchain and guesstimate their potential.

Let’s start with the basics

According to wiki, an NFT (non-fungible token) is a unique and non-interchangeable unit of data stored on a digital ledger (blockchain). And then, according to N26: If something is “non-fungible,” it means it can’t be swapped for something of completely equal value. A tract of land would be non-fungible, since land is unique, and finding another tract with the exact same value would be difficult to impossible. Art is another example of a non-fungible asset, since its value is highly subjective—and this is where NFT’s come in. An NFT shows exclusive ownership of a particular digital asset (e.g., a piece of art, an in-game purchase, or a tweet).

So NFTs are proof of ownership2 of a digital asset. That means that you can save the asset in your hard drive by right-clicking, but it is not owned by you. It becomes more complex as the NFT is not the asset per se (that is, buying the NFT of a tweet does not mean that you can delete the tweet) and helps as thinking of them as a kind of agreement between two parties, the seller (who could or could not be the creator of the asset) and the buyer, but more on that later.

And now let’s take a step back … in time

The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for nonreversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party

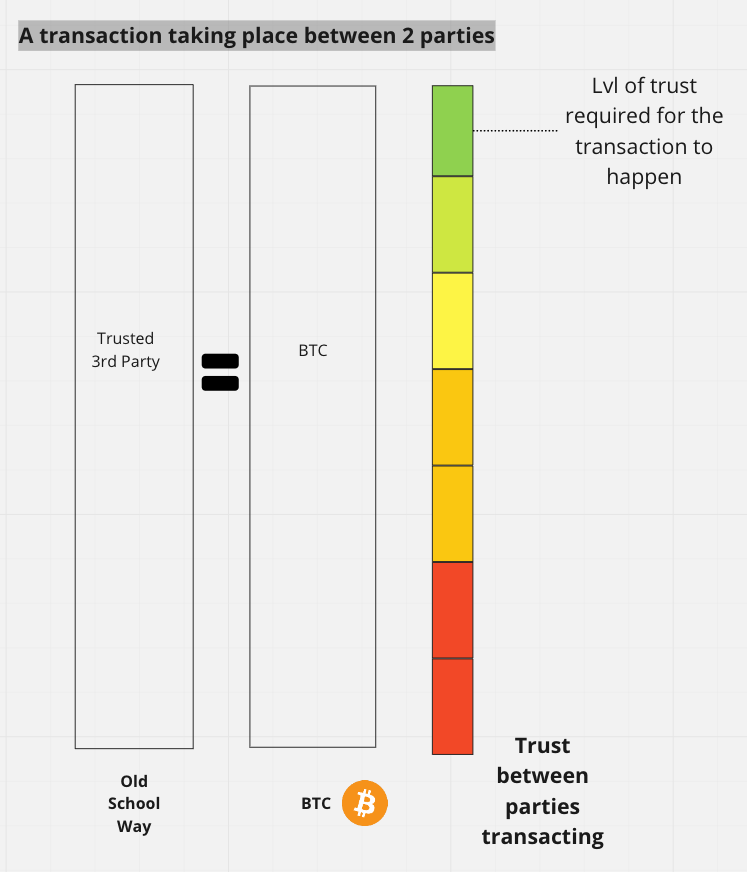

These are the first lines on the introductory section of the archetypal “bitcoin paper”, written by the pseudonymous, elusive, and legendary Satoshi Nakamoto, back in 2008. It clearly states the problem that bitcoin is trying to solve: in order for a transaction between 2 parties to happen, trust is necessary. And trust is ensured by a 3rd party, e.g. a trusted financial institution. But this is an inefficient way of transacting, so Satoshi proposed an “…electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party…”

In a simplistic manner, it would work like this with a digital currency on the blockchain:

Now, fast forward to the future

Our first stop is the following occasion (it has the setup of a joke but it’s 100% true). A guy is sitting in a panel, explaining NFTs to Quentin Tarantino.

If you were to NFTize every shot of Pulp Fiction, the one where the two of them are holding the guns (it’s John Travolta and Samuel Jackson for heaven’s sake) has become that meme image, holy Christ!, this would sell for millions for sure. Tens of millions? That one frame.

Tarantino replies,

Ok, ok, to not sound like a clueless dork, how is that different from all the stills that already exist? Who doesn’t have that? Who doesn’t have that bootleg poster on their wall?

the NFT guy hits back

This is where it gets interesting (don’t you f’in hate when people use this phrase like they are about to reveal God’s truth?). Right-click save right? This is the big issue in the NFT space. But the image of the NFT isn’t the thing, it’s the sense of ownership. Now when you own it, we’re down to the blockchain. At that level, think of that image as having matrix code (dude, wtf?) inside. And now I can detect whether you have the real one, or the fake one. If you have the real one, you can come and have dinner with Quentin every year.

But hold on a minute,

the impending threat of a copyright lawsuit aside, what’s stopping Tarantino from doing that now without any non-fungible thingies involved? Also, what is a “sense of ownership”? There’s either ownership or there isn’t.

Intermission: NFTs and copyrights

In a funny turn of events, Quentin Tarantino bought the NFT hype and went on to announce that he would be auctioning off excerpts of his original Pulp Fiction screenplay, which contain “secrets” about the film and his process as a creator. But Miramax, the company holding the rights to the film and the script had a somewhat different opinion.

To make matters clearer, one has to remember that NFTs are not copyrights.

The truth is, NFTs are just tokens that represent an asset, completely separate from the assets themselves. Because every NFT represents a unique asset, a single NFT can’t be duplicated while maintaining the same value as the original. Many equate this exclusive form of ownership with ownership of the work itself, but the distinction must be emphasized. This misconception goes further. The range of possibilities for what can be an NFT coincides surprisingly well with works eligible for copyright. While every jurisdiction defines “works” in different ways, none stray too far from the essentials. In Canada, for example, copyright protection extends to literary, artistic, dramatic or musical works in addition to performances, recordings and other related works. Creators need not apply for these protections — the state provides them inherently upon the creation of the work.….

So unless an external agreement is made between the artist and the buyer, the bundle of copyrights to an NFT still belong to the original artist.

So, in order to use the asset for commercial use, one would have to strike a traditional agreement with the copyrights holder. This is important to remember because if Tarantino got confused, everyone can.

In search for concealed value

Our second stop is this not-really-great piece by HBR, which sees part of the value of NFTs in functioning “…like membership cards or tickets, providing access to events, exclusive merchandise, and special discounts ..”. In essence, community-building is the word: “…All of this gives NFT holders value over and above simple ownership — and provides creators with a vector to build a highly engaged community around their brands. …”

The article ultimately gets it semi-right by attributing the value of NFTs in community ties:

NFTs enable new markets by allowing people to create and build upon new forms of ownership. These projects succeed by leveraging a core dynamic of crypto: A token’s worth comes from users’ shared agreement — and this means that the community one builds around NFTs quite literally creates those NFTs’ underlying value. And the more these communities increase engagement and become part of people’s personal identities, the more that value is reinforced.

In search of the true value of NFTs, and seeing a number of use cases, we constantly have to ask the following questions:

Could this have been achieved without resorting to NFTs?

If we do use NFTs, how would the experience be better?

One has to remember that due to switching costs, a product has to just offer a better experience overall but a much-much better one (e.g. faster, more efficient, transactions) in order for it to have a chance in winning. But, as in the Tarantino case, what’s stopping these perks from materializing without NFTs? There are membership cards and there are tickets today. Is an NFT offering a vastly better experience?

More on that in Part 2…. and this is where it will get interesting

Tweet of the Week

Quite an intriguing thread with a good number of suggestions for articles, podcasts, and books. The most upvoted reply refers to the Anthropic Bias book, which explores how to reason when you suspect that your evidence is biased by observation selection effects. I just started reading it and it looks pretty promising.

Until next time, take care and have a great week.3

The rabbit hole term refers to Alice in Wonderland but was made popular once more with the Matrix film series (blue pill, red pill)

A document such as a bill of sale, stock certificate, or license that verifies a person has title to something. Proof of ownership was originally paper documents, which later evolved to the creation of digital files. I’m having some thoughts (doubts perhaps) as to how “proof” would translate in a real transaction (e.g. would a court of law accept an NFT as proof of ownership?) but yet again, would this be so important?

Thanks to Andreas, Costa, Fotis & Calliope, for providing their $0.02 on this piece (or parts of it)

What happens when someone sells you an NFT without being the owner. What if Tarrantino sold these Pulp Fiction instances without Miramax knowing it?

I think a great challenge for the NFT market is to verify if the seller is actually the right owner (verification process). Until then a lot of people could get scammed (and this is the reason why most NFTs are from unknown artists)